What is Retirement Portfolio Service's USI number? 61808189263051

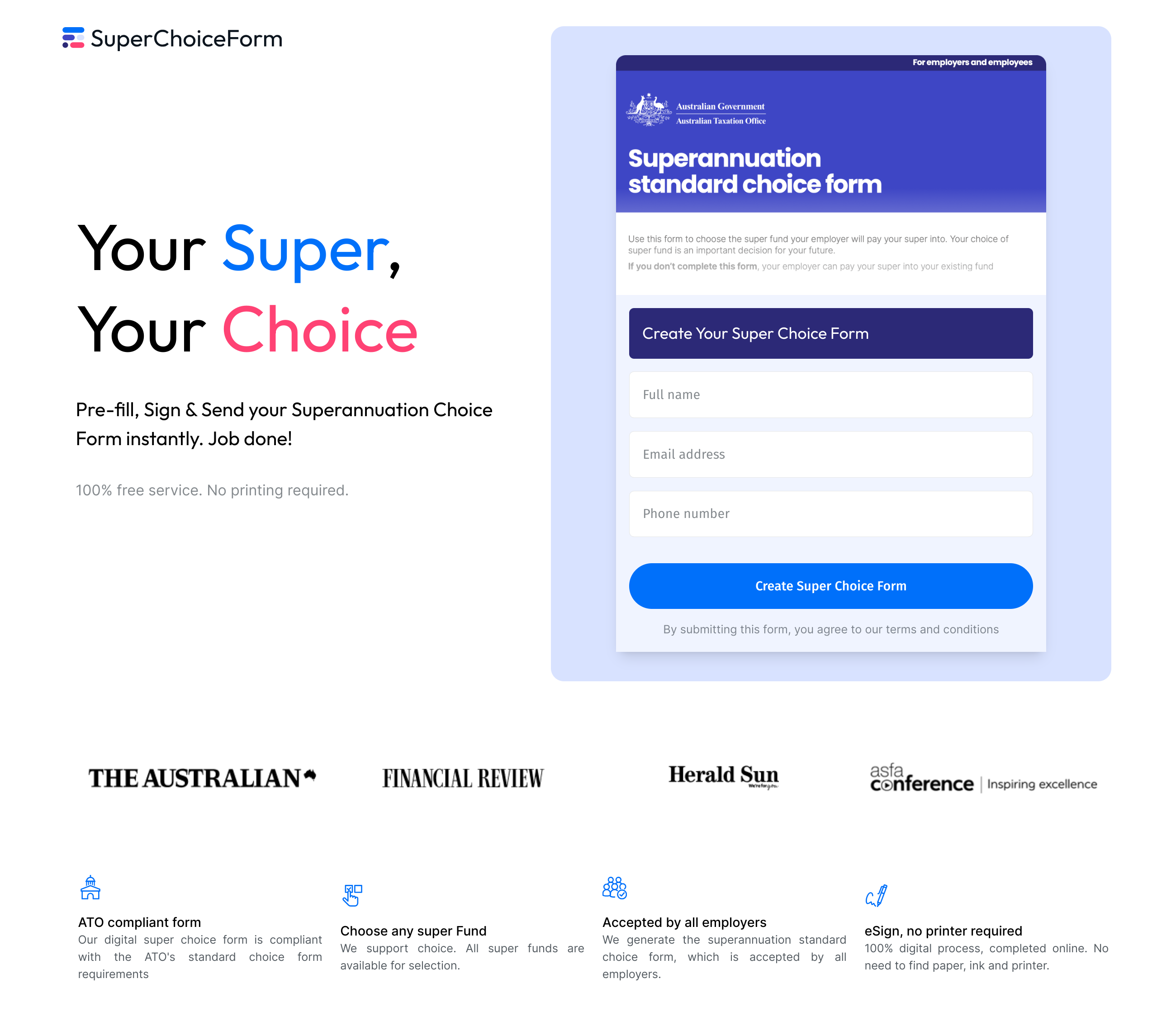

Are you still collecting super choice forms as paper or PDF's?

Solve it, with Xonboard, for free!

Stop manaully entering super details in your payroll system. Automate your employee onboarding today!

USI number is short for Unique Superannuation Identifier number. It was introduced as part of the SuperStream system, which came into effect in July 2014. The SuperStream system was introduced as a result of the Australian Federal Governments 'Stronger Super' reforms. The Stronger Super review was conducted between 2007 & 2013 and focused on the operation of Australia's superannuation scheme, it's structure and it's efficiency. SMSF funds are not issued a USI number, instead they use their ABN number as an identifier.

| Retirement Portfolio Service USI Number: | 61808189263051 |

Need help completing your Super Choice Form?

What is Retirement Portfolio Service's SPIN number? LEF0053AU.

SPIN number is short for Superannuation Product Identification number. A SPIN number identifies a super fund product, as opposed to the business entity, fund or trustee. It is used by government organsations and financial institutions to identify the super fund products that belong to a superfund. A superfund may have many products, each identified by a spin number, which are often referred to as 'superannuation plans'. The SPIN number was introduced as part of the SuperStream system, but it has now largely been replaced by the USI number.

Australian Prudential Regulation Authority (APRA) is largely responsible for managing SPIN numbers. They have their own directory available where you can look up spin codes. You can use thier portal as an official record of superannuation funds and their SPIN codes. It is a free service (just like SuperNumber) and available to the public via their website.

It was the Super EC Council that first announced the initative to introduce SPIN numbers. They delivered a set of guidelines for the standardaisation of the identification number system used for Superannuation funds & services in Australia. APIR system were awarded the contract to produce a portal that made the new identification system available to end users (the Australian public). The initiative was supported (and quickly adopted) by the superannuation industry.

This information is provided for historical context, as SPIN number have become largely redundant. Due to the newly introduced USI Number, you should look into whether you actually need a SPIN number or a USI number.

| Retirement Portfolio Service SPIN Number: | LEF0053AU |

The ABN number of Retirement Portfolio Service is 61 808 189 263

ABN stands for Australian Business Number. All business entities in Australia are required to register with the Australian governent in order to receive an ABN. Once registered, a unique abn is generated for the business and used as a unique identity for taxation and government reporting responsibilities. The Australian government provides a service to look up abn details. It can be used to determine abn, business name, address and status details.

All invoices must bear an ABN number to be considered a valid invoice in Australia. There can be penalties associated with generating & sending invoices that do not have an ABN present.

ABR is the Australian Business Registry service provided by the Australan government. They provide some fantastic tools for managing your business & reporting necessary details to the government. Through the ABR portal you can lookup your ABN & the details associated with other ABN's (one you've found on an invoice, for example).

Getting an ABN is free and easy, you can even do it online. Simply visit the ABR website, check that you're eligible, fill in a few details about your business and your ABN will be delivered by mail within a few days.

Not every business is eligible for an ABN (but 99% are). You need to be running (or about to start) a business within Australia (obviously). Employees are not applicable for an ABN, you would need to be a self contractor of some nature (the business would generally request an ABN from you, if it's applicable). You business activity needs to serious, not a hobby. If you're just kicking around a side project and don't intend to write invoices or make any money, don't bother with an ABN. Finally, taxation (GST). This only becomes necessary when you're turning over $75,000 or more within the business. This gives many businesses some leeway when it comes to GST, until their business starts to grow.

| Retirement Portfolio Service ABN Number: | 61 808 189 263 |

The RSE number, otherwise referred to as a Registerable Superannuation Entity Number, are issued to a superannuation to denote they're registered with the Australian Prudential Regulation Authority (APRA). RSE's are issued in accordance with section 56 of the Australian Prudential Regulation Authority Act 1998 and Part 11A of the Superannuation Industry (Supervision) Amendment Regulations 2004 (No. 3) 2004 No. 113.

Only a regulated superannuation fund or an approved deposit fund or a pooled superannuation trust is applicable for an RSE, a self managed super fund (SMSF) is not eligible. Provisions for the registration of RSEs is provided under Part 2B of the Superannuation Industry (Supervision) Act 1993 (the SIS Act). You can verify the RSE by looking up the fund ABN on the APRA website.

| Retirement Portfolio Service RSE Number: | R1000986 |

OnePath Super (fund provider) details

ABN number is short for Australian Business Number. An ABN is an 11 digit number which uniquely identifies a business entity. It it used by the community to provide a unique point of reference for a business. The ABN is also used by government for a number of tax & business reporting purposes. ABN's maintain a consistent pattern of 2, 3, 3 & 3 digits, for example: 22 333 333 333.

| Retirement Portfolio Service ABN Number: | 12 008 508 496 |

In addition to an RSE number, superannuation providers are also issued with a RSEL, Registerable Superannuation Entity Licence number, by the Australian Prudential Regulation Authority (APRA). An RSE Licensee is provided to entity to denote that it has attained a RSE Licence granted by APRA under section 29D of the SIS Act.

| Retirement Portfolio Service RSEL Number: | L0000673 |

All business that provides financial services must hold an Australian Financial Services Licence (AFS licence) in order to conduct their business. AFS licences are governed by the Australian Securities & Investment Commission (ASIC). All superannuation providers (or trustees) are considered financial services providers and therefore must hold an AFS licence in order to conduct their business.

| Retirement Portfolio Service AFSL Number: | 238346 |

More About Retirement Portfolio Service