What is Australian Retirement Trust's USI number? 98503137921001

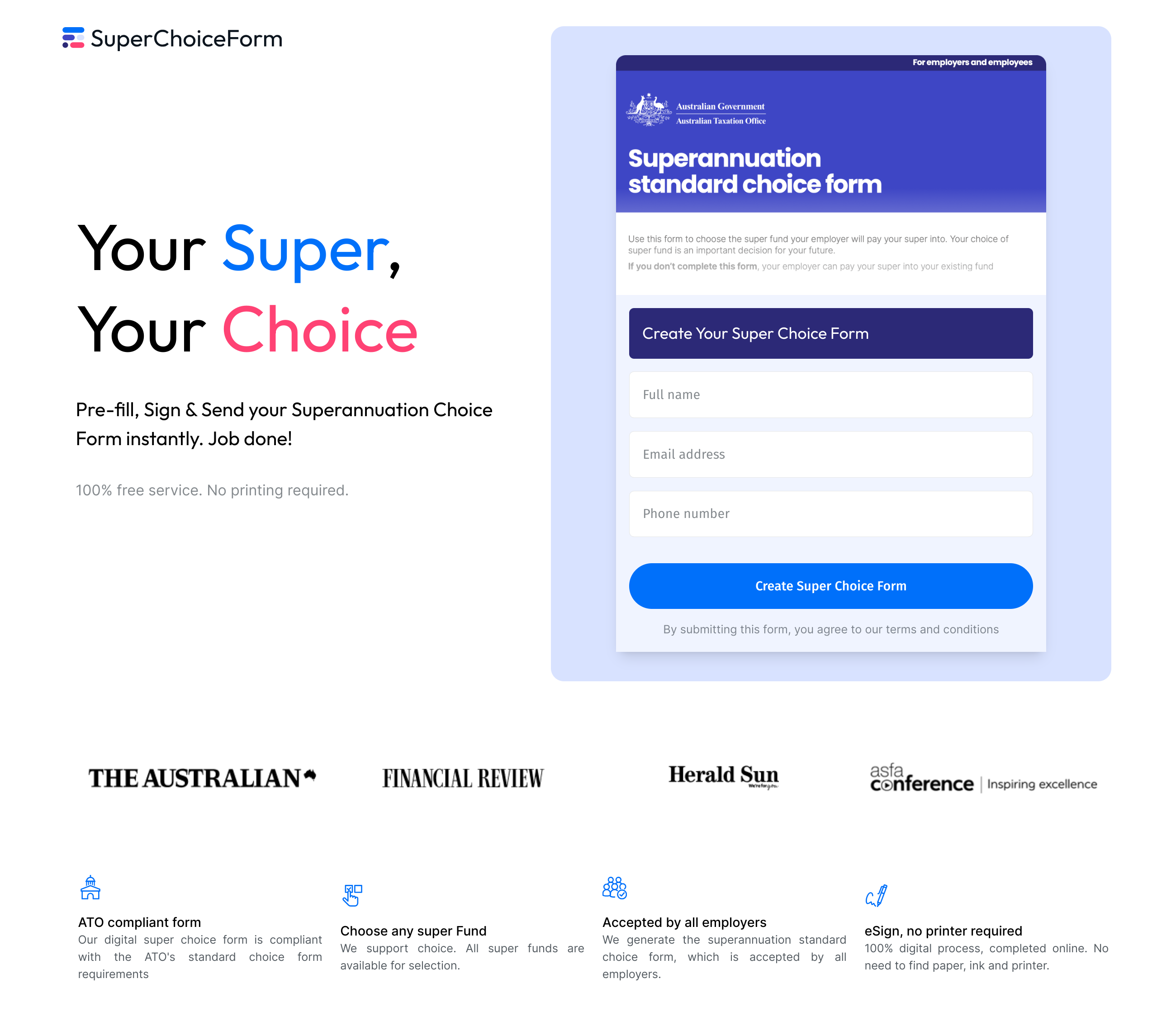

Are you still collecting super choice forms as paper or PDF's?

Solve it, with Xonboard, for free!

Stop manaully entering super details in your payroll system. Automate your employee onboarding today!

USI number is short for Unique Superannuation Identifier number. It was introduced as part of the SuperStream system, which came into effect in July 2014. The SuperStream system was introduced as a result of the Australian Federal Governments 'Stronger Super' reforms. The Stronger Super review was conducted between 2007 & 2013 and focused on the operation of Australia's superannuation scheme, it's structure and it's efficiency. SMSF funds are not issued a USI number, instead they use their ABN number as an identifier.

| Australian Retirement Trust USI Number: | 98503137921001 |

Need help completing your Super Choice Form?

The ABN number of Australian Retirement Trust is 60 905 115 063

ABN stands for Australian Business Number. All business entities in Australia are required to register with the Australian governent in order to receive an ABN. Once registered, a unique abn is generated for the business and used as a unique identity for taxation and government reporting responsibilities. The Australian government provides a service to look up abn details. It can be used to determine abn, business name, address and status details.

All invoices must bear an ABN number to be considered a valid invoice in Australia. There can be penalties associated with generating & sending invoices that do not have an ABN present.

ABR is the Australian Business Registry service provided by the Australan government. They provide some fantastic tools for managing your business & reporting necessary details to the government. Through the ABR portal you can lookup your ABN & the details associated with other ABN's (one you've found on an invoice, for example).

Getting an ABN is free and easy, you can even do it online. Simply visit the ABR website, check that you're eligible, fill in a few details about your business and your ABN will be delivered by mail within a few days.

Not every business is eligible for an ABN (but 99% are). You need to be running (or about to start) a business within Australia (obviously). Employees are not applicable for an ABN, you would need to be a self contractor of some nature (the business would generally request an ABN from you, if it's applicable). You business activity needs to serious, not a hobby. If you're just kicking around a side project and don't intend to write invoices or make any money, don't bother with an ABN. Finally, taxation (GST). This only becomes necessary when you're turning over $75,000 or more within the business. This gives many businesses some leeway when it comes to GST, until their business starts to grow.

| Australian Retirement Trust ABN Number: | 60 905 115 063 |

Australian Retirement Trust (fund provider) details

ABN number is short for Australian Business Number. An ABN is an 11 digit number which uniquely identifies a business entity. It it used by the community to provide a unique point of reference for a business. The ABN is also used by government for a number of tax & business reporting purposes. ABN's maintain a consistent pattern of 2, 3, 3 & 3 digits, for example: 22 333 333 333.

| Australian Retirement Trust ABN Number: | 88 010 720 840 |

All business that provides financial services must hold an Australian Financial Services Licence (AFS licence) in order to conduct their business. AFS licences are governed by the Australian Securities & Investment Commission (ASIC). All superannuation providers (or trustees) are considered financial services providers and therefore must hold an AFS licence in order to conduct their business.

| Australian Retirement Trust AFSL Number: | 228975 |

More About Australian Retirement Trust